What Types of Vehicles Can Be Used for Sangla OR/CR?

By Arvin

Posted on Feb 12, 2026

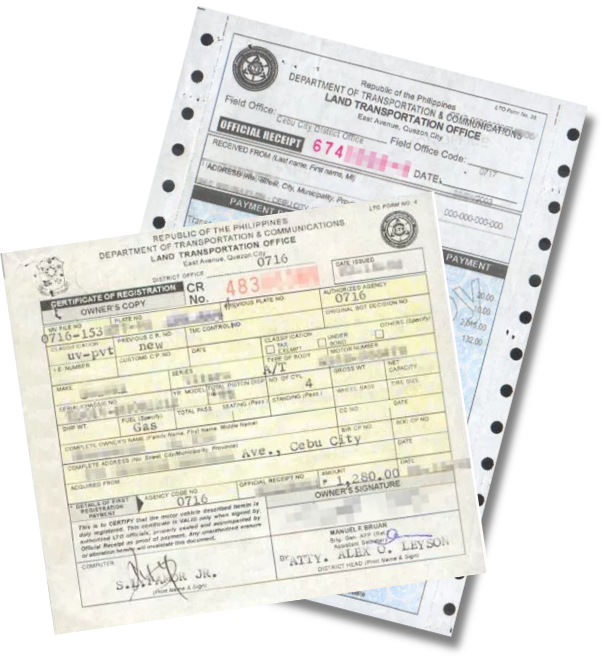

Need quick access to cash but don't want to sell your vehicle? A Sangla OR/CR loan allows you to unlock your vehicle's value by using your Official Receipt (OR) and Certificate of Registration (CR) as collateral—while still keeping your vehicle for daily or business use.

This type of vehicle-backed financing is a practical solution for individuals and business owners who need fast, flexible funding. However, not all vehicles automatically qualify. Lenders evaluate several factors, including vehicle type, age, condition, and documentation.

Here's a detailed guide to the vehicles commonly accepted for Sangla OR/CR loans.

1. Private Cars

Sedans, hatchbacks, SUVs, crossovers, and select luxury vehicles are commonly accepted for OR/CR loans. Lenders typically assess:

- Vehicle age

- Mileage

- Overall condition

- Market resale value

Well-maintained private vehicles with complete documentation often qualify for competitive loan amounts.

2. Motorcycles and Scooters

Motorcycles and scooters are widely eligible, especially units from established brands with substantial resale value. These are commonly used for:

- Delivery services

- Daily commuting

- Small business operations

Because of their steady demand in the resale market, motorcycles can be approved quickly under OR/CR loan programs.

3. Jeepneys, Vans, and Utility Vehicles

Public utility and transport vehicles such as jeepneys, vans, and minibuses may also qualify. Since these units often generate income, they can command higher appraised values depending on condition and operational status.

For operators and business owners, this type of vehicle collateral loan can provide working capital for maintenance, expansion, or emergency expenses.

4. Trucks and Commercial Vehicles

Many OR/CR lenders typically accept cargo trucks, delivery vans, and other commercial vehicles. These vehicles are valuable assets for:

- Logistics operations

- Construction services

- Distribution and trading businesses

Using commercial vehicles as collateral allows business owners to access funds while keeping operations uninterrupted.

5. Specialty Vehicles

Some lenders may accept specialty vehicles such as:

- Trailers

- Farm equipment

- Construction machinery

Approval depends on documentation, resale value, and current condition. A valid OR/CR and proper registration are essential.

Key Requirements for Sangla OR/CR Approval

Before applying for a Sangla OR/CR loan, consider the following:

Valid and Updated OR/CR

The vehicle must have complete and updated registration documents. Inconsistent or incomplete paperwork may delay or affect approval.

Good Running Condition

Most lenders require a physical inspection. Vehicles in good working condition typically qualify for better loan offers.

Acceptable Vehicle Age

Many lenders prefer vehicles that are 15 years old or younger, though approval policies vary by vehicle type and condition.

Loan Amount Based on Appraised Value

The approved loan amount depends on the vehicle's market value, age, type, and condition.

Final Thought

Whether you own a private car, motorcycle, van, truck, or specialty vehicle, a Sangla OR/CR loan can help you convert your vehicle documents into fast working capital. It's a practical financing option that provides liquidity while allowing you to retain full use of your vehicle.

Through Vigattin Insurance's financing services, applicants can receive assistance in comparing partner lenders, understanding eligibility requirements, and securing competitive loan terms. The process is structured to be straightforward, transparent, and efficient—helping you access funds quickly while keeping your vehicle where it belongs: on the road and working for you.